Mastering Your Money: Your Simple Net Worth Excel Template Guide For Clarity

Do you ever just wonder where all your money actually goes, or maybe where it really sits? It's a feeling many of us share, that slight unease about not quite knowing the full picture of our finances. You know, like, are things moving in the right direction, or are they kind of just drifting along? It's a pretty common thought, actually, to want a clearer view of your financial standing, and that's exactly where a good net worth Excel template comes into play. It's about bringing some calm to that financial puzzle, so you can really see what's what.

A lot of people feel a bit overwhelmed when they think about personal finance, too it's almost like it's this big, complicated thing. But, really, it doesn't have to be. A simple, well-organized spreadsheet can cut through a lot of that confusion. It gives you a straightforward way to track what you own and what you owe, which is, you know, the very core of figuring out your net worth. It’s a tool that helps you get a grip on your financial reality, kind of like a snapshot.

This kind of template, you see, is more than just a bunch of numbers. It’s a way to truly understand your financial journey. It helps you spot trends, celebrate small wins, and, really, make smarter choices about your money going forward. It's a powerful thing, actually, to have that kind of insight right there at your fingertips, pretty much anytime you need it.

Table of Contents

- Why Track Your Net Worth?

- Seeing the Big Picture

- Setting Smart Goals

- Making Better Choices

- What Goes Into Your Net Worth? (Assets vs. Liabilities)

- Your Assets: What You Own

- Your Liabilities: What You Owe

- Building Your Own Net Worth Excel Template

- Setting Up Your Spreadsheet

- Key Sections to Include

- Tips for Keeping It Updated

- Beyond the Numbers: Making Your Template Work for You

- Visualizing Progress

- Understanding the Trends

- Staying Motivated

- Common Questions About Net Worth Templates

- How do you calculate net worth in Excel?

- What should be included in a net worth statement?

- Is a high net worth always good?

Why Track Your Net Worth?

You might be thinking, "Why bother with all this tracking?" Well, it's pretty simple, actually. Knowing your net worth is like having a financial GPS. It shows you exactly where you are right now, and that's, you know, the first step to figuring out where you want to go. It's about getting a sense of direction, which is pretty important for anyone, really, who wants to feel more secure with their money.

Seeing the Big Picture

When you track your net worth, you get this really clear, single number that sums up your financial situation. It's not just about how much you have in your checking account, or how much you owe on your credit cards. It’s about putting all those pieces together, so you can see the whole puzzle. This big picture helps you, you know, understand your overall financial health, which is a pretty good thing to have.

It’s kind of like looking at a map of your entire financial world, so to speak. You see all the roads you've traveled and all the places you could go. This kind of overview, actually, helps you see if your financial actions are lining up with your goals. It's a simple way to gain a lot of clarity, really, about where you stand.

Setting Smart Goals

Once you know your starting point, it becomes so much easier to set meaningful financial goals. Maybe you want to save for a down payment on a house, or perhaps you're looking to retire early. Having a net worth template means you can track your progress towards these bigger goals, which is very motivating. You can actually see the numbers move, and that's a powerful thing.

For example, if you see your net worth slowly going up each month, that's a sign you're doing something right, you know? It reinforces good habits. And if it's not moving as much as you'd like, well, that's also good information. It gives you a chance to adjust your plans, sort of like, recalibrating your course, which is pretty useful.

Making Better Choices

With a clear picture of your net worth, you're just better equipped to make smart money decisions. Should you pay off that loan faster? Is now a good time to invest more? These questions become a lot less confusing when you have your net worth data right there. It helps you avoid impulsive choices and, you know, think more strategically about your money.

It’s like having a personal financial advisor, but it’s just your own spreadsheet, really. You can run different scenarios in your head, or even in the template itself, to see how they might affect your overall financial standing. This kind of thoughtful approach, I mean, it just leads to better outcomes in the long run, pretty much always.

What Goes Into Your Net Worth? (Assets vs. Liabilities)

Figuring out your net worth is basically a simple math problem: what you own minus what you owe. The trick, though, is knowing what counts as what. It's all about separating your assets from your liabilities, and that's, you know, a fundamental step in building your template.

Your Assets: What You Own

Assets are anything of value that you possess. Think of them as the things that could, in theory, be turned into cash. It's not just the money in your bank account, either. There are lots of different kinds of assets that contribute to your overall financial picture, so it's good to list them all out.

Here are some common things you might include:

- Cash in checking and savings accounts: This is pretty straightforward, you know, the money you can access easily.

- Investments: This could be stocks, bonds, mutual funds, retirement accounts like 401(k)s or IRAs, and even cryptocurrency holdings.

- Real Estate: The current market value of your home, rental properties, or any land you own.

- Vehicles: The current market value of your cars, motorcycles, or boats.

- Other Valuables: This might include jewelry, art, or other significant personal possessions that have a substantial resale value.

You want to be pretty honest with yourself about the value of these things, too. For instance, a car's value drops pretty quickly, so using its purchase price isn't really accurate after a while. You're looking for what it could sell for today, more or less.

Your Liabilities: What You Owe

Liabilities are the opposite of assets; they are your debts, the money you owe to others. These are the things that reduce your net worth. Keeping a clear list of these is just as important as tracking your assets, actually, because they tell a big part of your financial story.

Some typical liabilities you'll want to track include:

- Mortgage: The outstanding balance on your home loan.

- Student Loans: Any money you still owe for your education.

- Car Loans: The remaining balance on your vehicle financing.

- Personal Loans: Money borrowed from banks or individuals.

- Credit Card Debt: The total balance you owe across all your credit cards.

- Other Debts: This could be medical bills, tax obligations, or any other money you're legally obligated to pay back.

It's important to track these balances regularly, because, you know, paying them down is a big part of increasing your net worth. Seeing those numbers shrink can be a really satisfying thing, actually, and it helps you stay focused on getting out of debt.

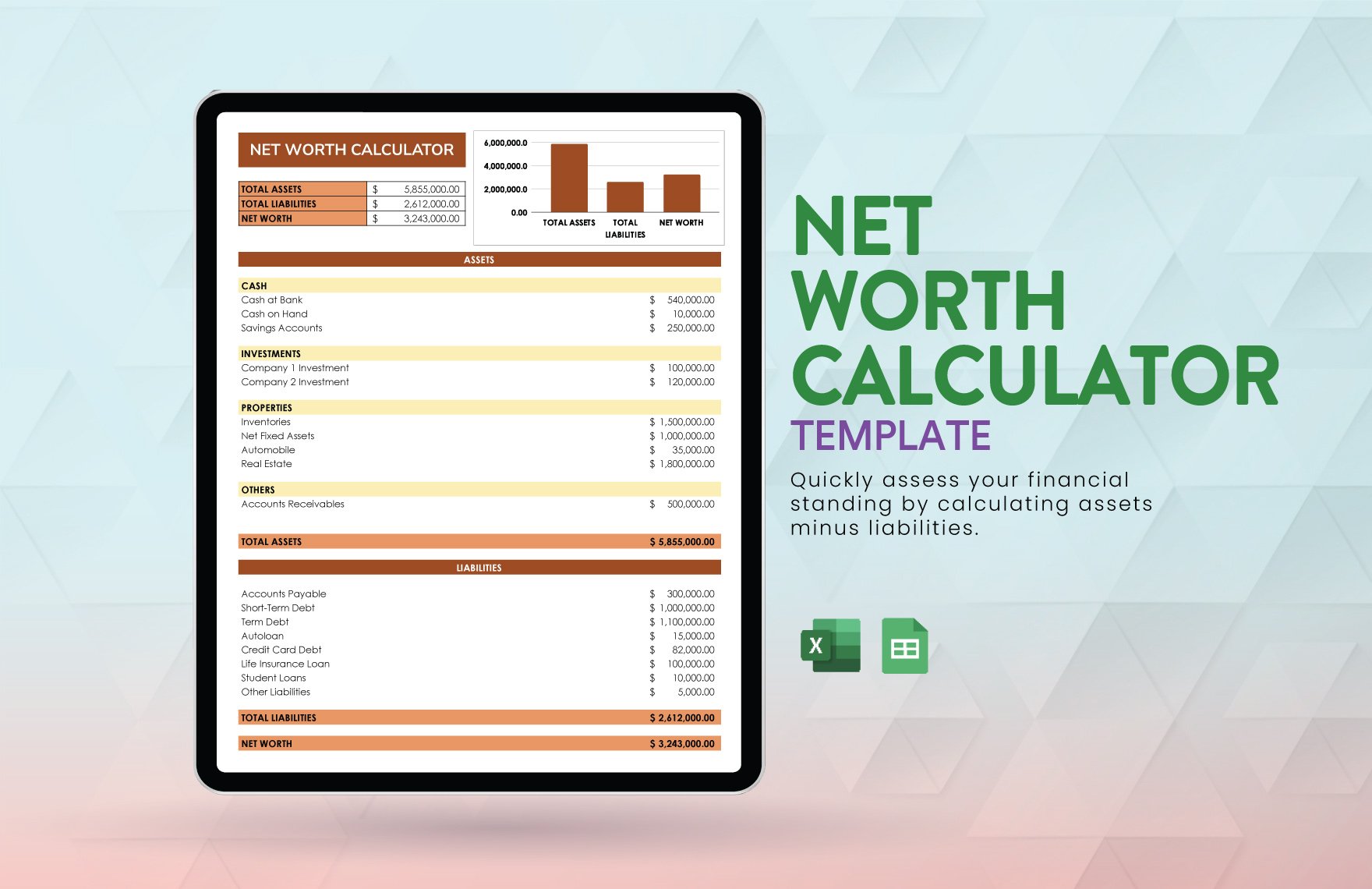

Building Your Own Net Worth Excel Template

Creating your own net worth Excel template is actually simpler than you might think. You don't need to be an Excel wizard or anything like that. The goal is to make something that works for you, that's easy to update, and that gives you the information you need, so it's pretty user-friendly.

Setting Up Your Spreadsheet

Start with a fresh spreadsheet. You'll want to create clear headings for your different categories. A good way to organize it is to have separate sections for assets and liabilities. You can even have a column for the date you're recording the values, which is very helpful for tracking changes over time.

For example, you might have columns like "Asset Category," "Description," "Current Value," and "Date Updated." Below that, you'd list your specific assets. Then, a separate section for liabilities with similar columns. The real magic happens with a few simple formulas. You'll use `SUM` to add up all your assets and all your liabilities. Then, a simple subtraction formula (Assets - Liabilities) will give you your net worth. It's pretty basic math, really, but it makes a big difference.

Key Sections to Include

To make your template truly useful, you'll want to break down your assets and liabilities into logical groups. This makes it easier to input data and, you know, understand where your money is sitting. It’s about organizing things in a way that makes sense to you, basically.

Consider these sections:

- Cash Accounts: This includes your checking accounts, savings accounts, and any cash you have on hand. It's your most liquid money, so it's a good place to start.

- Investments: List out your brokerage accounts, retirement funds, and any other investment vehicles. You'll typically update these based on their current market value.

- Real Estate: Your primary residence, any rental properties, or other land. You might get an estimate of value from online tools or a real estate agent.

- Vehicles & Other Valuables: Your cars, boats, and any significant items like jewelry or collectibles. Again, use current market values.

- Loans & Debts: This is where you list things like your mortgage, student loans, and car loans. Keep track of the outstanding principal balance.

- Credit Cards: All your credit card balances go here. It's good to see this number, you know, as it can fluctuate quite a bit.

Having these clear categories helps you remember what to update and, honestly, makes the whole process feel less daunting. It's just a clear roadmap, pretty much.

Tips for Keeping It Updated

A net worth template is only useful if it's current. You know, old data doesn't really help you make present decisions. So, setting a regular schedule for updates is pretty important. Some people do it monthly, others quarterly. Pick a frequency that works for you and stick to it, basically.

When you update, just go through each category. Check your bank statements, investment account balances, and loan statements. It might take a little bit of time at first, but it gets faster with practice. And, really, seeing that net worth number change, hopefully for the better, is a great motivator to keep at it. It's like, a little financial ritual, in a way, that really pays off.

Beyond the Numbers: Making Your Template Work for You

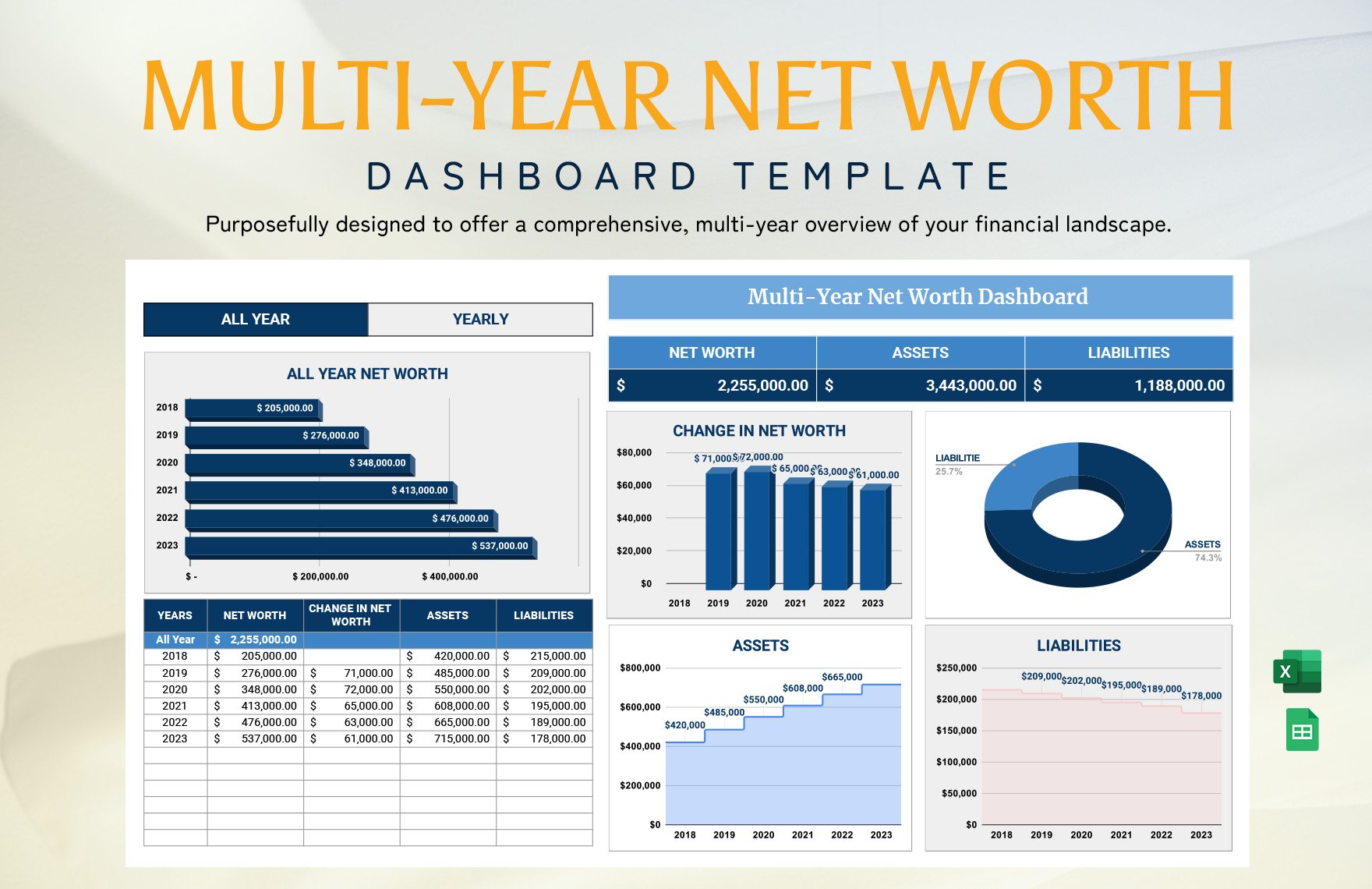

Your net worth Excel template isn't just for calculating a single number. It's a tool for insight, you know? It can help you understand trends, visualize your progress, and stay really motivated on your financial path. It's about getting more than just a calculation; it's about getting a deeper understanding, pretty much.

Visualizing Progress

One of the coolest things you can do with your template is create simple charts. Excel makes this pretty easy. You could make a line graph showing your net worth over time, for instance. Or a pie chart breaking down your assets. Seeing your progress visually can be incredibly powerful, actually, and it's a great way to stay engaged.

A graph, you know, just tells a story that numbers alone sometimes don't. You can see those ups and downs, and, hopefully, a general upward trend. It's a very satisfying way to track your financial health, really, and it helps you appreciate how far you've come, too.

Understanding the Trends

When you regularly update your template, you start to notice patterns. Maybe your investment accounts are growing steadily, or perhaps your credit card debt is slowly shrinking. These trends are super important because they show you what's working and what might need a little more attention. It's like, your money is talking to you, and the template helps you listen.

If you see a dip in your net worth, for example, you can look back and see what happened that month. Did you make a big purchase? Did an investment drop in value? This kind of analysis, you know, helps you learn from your financial history and make better decisions going forward. It's a continuous learning process, basically.

Staying Motivated

There will be times when your net worth might not move as much as you'd like, or it might even dip a little. That's totally normal, and it's okay. The important thing is to keep tracking. Seeing the overall trend, rather than just one month's snapshot, helps you stay focused on the long game. It's a marathon, not a sprint, as they say, and your template is your training log.

Celebrate those small victories, too. Every time your net worth goes up, even a little bit, that's a win. This consistent tracking, actually, builds financial discipline over time. It makes you feel more in control, and that feeling, I mean, is pretty invaluable for your peace of mind. Learn more about personal finance strategies on our site, and link to this page for more budgeting tips.

Common Questions About Net Worth Templates

People often have similar questions when they start thinking about tracking their net worth. Let's tackle a few of those, just to make things a little clearer, you know, because it's good to cover the basics.

How do you calculate net worth in Excel?

Calculating net worth in Excel is actually pretty straightforward. You just need two main totals: your total assets and your total liabilities. First, create a section where you list all your assets (like cash, investments, property) and sum them up. Then, create another section for all your liabilities (like mortgages, loans, credit card debt) and sum those up, too. Finally, in a separate cell, you simply subtract your total liabilities from your total assets. The formula would look something like `=SUM(Total_Assets_Cell) - SUM(Total_Liabilities_Cell)`. It's really that simple, basically, a basic subtraction, and it gives you your net worth number.

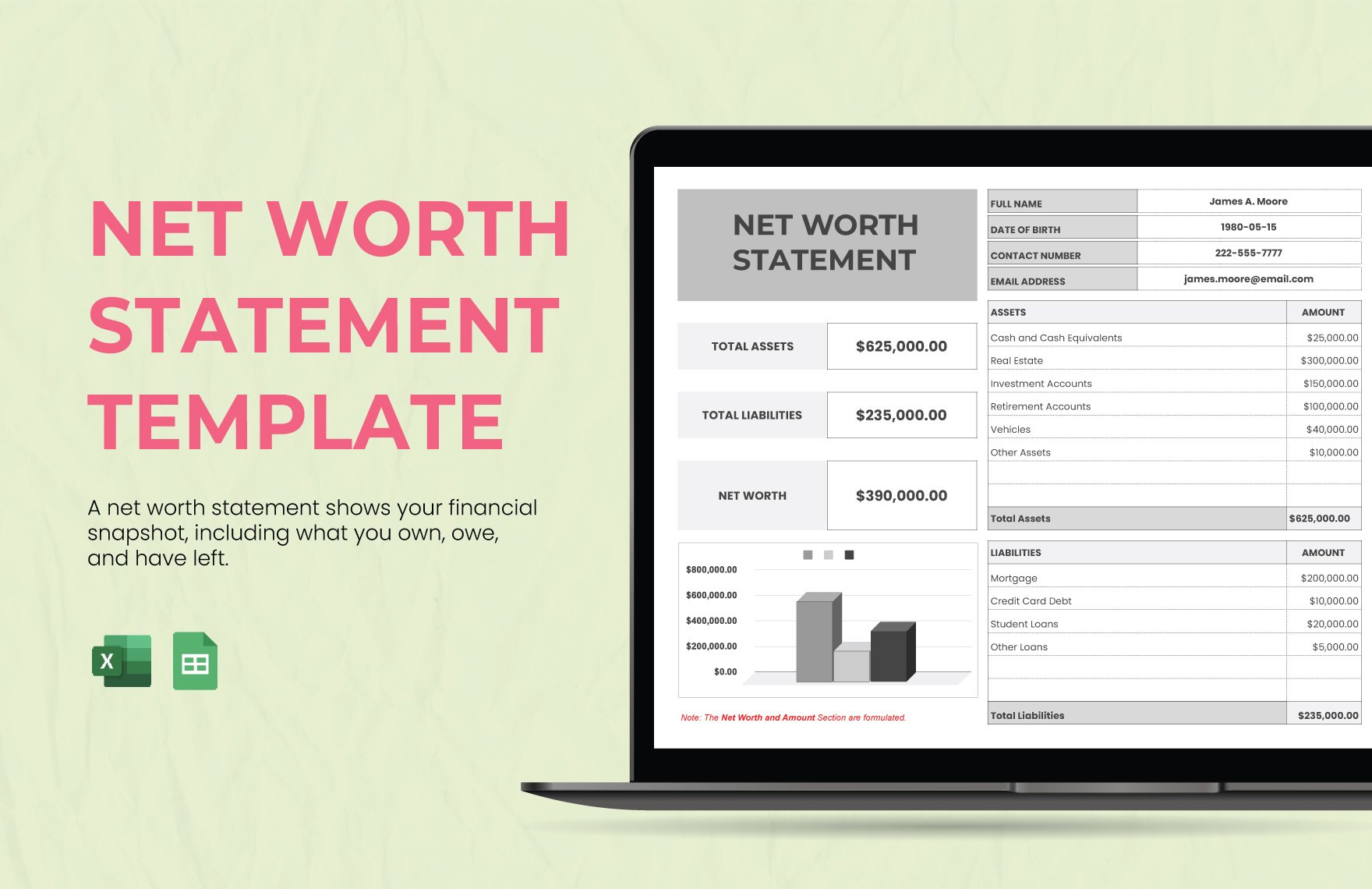

What should be included in a net worth statement?

A good net worth statement, or template, should include everything you own that has value (assets) and everything you owe (liabilities). For assets, think about things like your checking and savings account balances, the current value of your investments (stocks, bonds, retirement accounts), the market value of any real estate you own, and even the value of your vehicles or significant personal possessions. For liabilities, you'll want to list all your debts: your mortgage balance, student loans, car loans, personal loans, and credit card balances. The more complete you are, you know, the more accurate your net worth picture will be, which is pretty important for making good decisions.

Is a high net worth always good?

Generally speaking, a higher net worth is seen as a positive thing, as it means you have more assets than debts, which is, you know, a sign of financial strength. However, it's not the only measure of financial well-being. Someone might have a high net worth but also have very little liquid cash, or they might be house-rich but cash-poor, meaning most of their wealth is tied up in their home. Also, a high net worth doesn't always mean someone is happy or has achieved their personal goals. It's a really good indicator of financial health, yes, but it's just one piece of the puzzle. It's important to consider your overall financial goals and lifestyle, too, not just that single number.

Free Editable Net Worth Templates in Excel to Download

Free Editable Net Worth Templates in Excel to Download

Free Editable Net Worth Templates in Excel to Download