Jesse Livermore Net Worth: Unpacking The Wealth Of A Trading Legend

Jesse Livermore, a name that echoes through the halls of financial history, still sparks curiosity, doesn't it? People often wonder about the sheer scale of his wealth, the incredible sums he accumulated, and, perhaps just as much, the dramatic losses he faced. He was, in a way, a titan of the early 20th-century stock market, a figure whose life story feels almost like a financial rollercoaster, full of astonishing highs and devastating lows. His reputation as the "Great Bear of Wall Street" and his legendary ability to predict market turns have kept his name alive, even today, prompting many to ask: just what was Jesse Livermore's net worth at his peak?

It's a question that, quite frankly, gets to the heart of what fascinates us about wealth and ambition. Livermore wasn't just a trader; he was, you know, a pioneer in many respects, operating in an era before modern regulations, before the kind of instant information we have now. His methods, often intuitive and based on keen observation, were revolutionary for his time. So, figuring out his net worth isn't just about a number; it's about understanding the financial power he wielded and the impact he had on the markets.

His story, actually, is more than just about money; it's about the very human struggle with greed, fear, and the relentless pursuit of market mastery. We'll explore the incredible peaks of his fortune, the strategies he used, and the eventual, sad decline that followed. It's a tale that still offers valuable lessons for anyone interested in the stock market, or really, anyone interested in the ups and downs of life itself, you know.

Table of Contents

- Biography of Jesse Livermore

- Personal Details and Bio Data

- The Early Days and Bucket Shops

- Making Millions: The 1907 Panic and Beyond

- The Peak of His Wealth: The 1929 Crash

- Jesse Livermore's Trading Philosophy

- The Downs and Final Years

- Lessons From a Legend

- Frequently Asked Questions About Jesse Livermore

Biography of Jesse Livermore

Jesse Lauriston Livermore was born in 1877 in Shrewsbury, Massachusetts, a small town that was, you know, a far cry from the bustling financial world he would one day dominate. His early life was pretty humble. He showed a knack for numbers and a sharp mind from a very young age, a bit of a prodigy, really. At just 14 years old, he left home, apparently with only a few dollars in his pocket, and found work as a board boy in a Boston stockbrokerage firm. This job involved writing stock quotes on a chalkboard, a task that, in a way, gave him his first real glimpse into the rhythms of the market.

It was here, watching the numbers change, that he began to notice patterns, to form his own ideas about how prices moved. He would scribble down his predictions and then compare them to what actually happened. This early, self-taught analysis was, you know, the foundation of his incredible career. He started making small bets in "bucket shops," which were basically unofficial betting parlors where people could gamble on stock prices without actually buying or selling shares. These places were, in some respects, his first training ground, and he quickly became so good at predicting the market that many bucket shops eventually banned him.

His journey from a board boy to one of the most famous, and infamous, traders in history is quite a remarkable one. He experienced both immense success and crushing failures, becoming a symbol of both the incredible potential and the inherent risks of speculating in the financial markets. His life, truly, offers a fascinating look at the human element within the world of money.

Personal Details and Bio Data

| Full Name | Jesse Lauriston Livermore |

| Born | July 26, 1877, Shrewsbury, Massachusetts, USA |

| Died | November 28, 1940, New York City, USA |

| Occupation | Stock Trader, Speculator |

| Nickname | The Great Bear of Wall Street, Boy Plunger |

| Known For | Making and losing multiple fortunes, predicting market crashes, pioneering trading strategies |

| Spouses | Nettie Jordan (m. 1900; div. 1917), Dorothy Wendt (m. 1918; div. 1932), Harriet Metz Noble (m. 1933; d. 1940) |

| Children | Jesse Livermore Jr., Paul Livermore |

The Early Days and Bucket Shops

Jesse Livermore's introduction to the financial world began, as we mentioned, in those rather unusual bucket shops. These establishments, which were quite common in the late 19th and early 20th centuries, weren't legitimate exchanges. Instead, they allowed people to place bets on stock prices without actually owning the underlying shares. It was, you know, a bit like a casino for stocks. For a young man like Jesse, with his sharp mind and keen observation skills, these places were a perfect, if somewhat risky, training ground.

He started with very small amounts, often just a few dollars, and through careful study of price movements, he began to win consistently. He would observe the ticker tape, looking for patterns, for the subtle shifts that indicated where a stock might go next. His success was, in some respects, uncanny. He developed a system, almost instinctively, for identifying trends and anticipating reversals. He was, actually, so good that the proprietors of these bucket shops started to realize they were losing money to him, quite a lot of money, too. They began to ban him, one after another, as he became too profitable for their business model.

This early period taught him invaluable lessons about market psychology and the importance of timing. It also showed him the limitations of dealing with intermediaries who had a vested interest in his failure. These experiences pushed him towards the legitimate exchanges of Wall Street, where he could truly test his abilities against the market itself, rather than against a bookie, you know. It was a crucial step in his journey to becoming a legend.

Making Millions: The 1907 Panic and Beyond

One of Jesse Livermore's first truly massive successes came during the Panic of 1907. This was a period of severe financial crisis in the United States, marked by a sharp decline in stock prices and numerous bank failures. While most people were losing their shirts, Livermore, with his characteristic foresight, saw an opportunity. He had been, in a way, anticipating a market downturn, and when it hit, he was ready.

He began to short the market heavily, betting that prices would continue to fall. His conviction was, frankly, so strong that he made an enormous amount of money as the market plunged. It's said that during this panic, he made over a million dollars in a single day, a truly staggering sum for that era. To give you some perspective, a million dollars in 1907 would be worth, you know, tens of millions, possibly even hundreds of millions, in today's money. This triumph cemented his reputation as a formidable force on Wall Street, earning him the nickname "Boy Plunger" for his daring and often contrarian bets.

However, even with such a monumental win, Livermore's path was never a straight line of success. He experienced several bankruptcies throughout his career, often due to overextending himself, or perhaps, you know, not adhering strictly enough to his own rules. But each time, he managed to rebuild his fortune, learning from his mistakes and coming back stronger. These periods of rebuilding, actually, are just as important to his story as his big wins, demonstrating his resilience and his deep understanding of market dynamics. He was, in some respects, always adapting, always learning, even if the lessons were sometimes incredibly painful.

The Peak of His Wealth: The 1929 Crash

Jesse Livermore's most legendary triumph, and the moment he likely reached the absolute peak of his net worth, came during the catastrophic stock market crash of 1929. While the rest of the world watched their fortunes evaporate, Livermore was, you know, once again on the right side of the trade. He had been carefully observing the market for months, seeing the speculative bubble inflating, and he had the courage and conviction to act on his analysis, even when it went against the prevailing optimism.

He began to build massive short positions, betting against the market, even as his own brokers and friends urged him to reconsider. His actions were, frankly, incredibly risky, but his conviction was absolute. When the market finally collapsed in October 1929, leading to the Great Depression, Livermore's short positions paid off spectacularly. It's widely reported that he made over $100 million during that crash. To put that into perspective, $100 million in 1929 would be equivalent to several billion dollars today, making him one of the wealthiest individuals in the world at that time, truly. He was, in a way, the ultimate contrarian, thriving when others crumbled.

This period marked the zenith of his financial power. His net worth was, quite simply, astronomical. He owned multiple homes, yachts, and lived a life of immense luxury. Yet, even at this peak, the seeds of future challenges were perhaps being sown. The psychological toll of such high-stakes trading, and the inherent instability of his methods, would eventually, you know, catch up with him. But for a brief, shining moment, Jesse Livermore stood as a testament to the power of independent thought and audacious market speculation.

Jesse Livermore's Trading Philosophy

Jesse Livermore wasn't just lucky; he developed a sophisticated, albeit largely intuitive, trading philosophy that guided his decisions. One of his core tenets was the importance of observing and understanding market psychology. He believed that prices were driven by human emotions—fear and greed—and that by understanding these emotions, one could predict market movements. He often said, "The game taught me the game," meaning his experience was his best teacher, you know.

He was a master of trend following, but with a crucial twist. He didn't just follow trends blindly; he waited for confirmation, for the market to signal its true direction before committing large amounts of capital. He called this "waiting for the line of least resistance." If a stock was trending up, he would buy; if it was trending down, he would sell short. But he would wait until the trend was clearly established, avoiding premature entries that could lead to losses. This patient approach was, in some respects, key to his success.

Another vital part of his strategy was pyramiding, but only in the direction of a winning trade. If he bought a stock and it went up, he would buy more, adding to his position as it moved favorably. However, he never averaged down on a losing position, a mistake many traders make. He famously said, "Always sell what shows you a loss and keep what shows you a profit." This discipline of cutting losses quickly and letting profits run was, frankly, a revolutionary concept for its time, and it's still a cornerstone of sound trading practice today. He also emphasized the importance of capital preservation and, you know, avoiding overtrading. He understood that the market would always be there, and patience was a virtue.

He also stressed the importance of having a trading plan and sticking to it, rather than being swayed by tips or emotions. He believed in doing his own research and trusting his own judgment. For more insights into his enduring principles, you might find it helpful to explore his trading rules, which are still studied by traders today. Learn more about market history on our site, and link to this page understanding trading psychology.

The Downs and Final Years

Despite his incredible successes, Jesse Livermore's life was also marked by dramatic reversals of fortune. He experienced several bankruptcies throughout his career, losing millions multiple times. These losses were often due to personal indiscretions, emotional trading, or, you know, simply overextending himself in the market. He had a tendency to become overconfident after big wins, which sometimes led him to abandon his own carefully crafted rules.

After the 1929 crash, while he was at his financial peak, his personal life became increasingly troubled. He faced marital problems, legal issues, and a series of poor investments that chipped away at his vast fortune. The pressures of constant high-stakes trading, the public scrutiny, and his own internal struggles began to take a heavy toll. He was, actually, a very private man, and the constant attention, coupled with his financial losses, weighed heavily on him.

By the late 1930s, his trading prowess seemed to wane. He filed for bankruptcy for the fourth and final time in 1934, stating that he had debts of $2.5 million and assets of only $180,000. It was a stark contrast to the billions he had commanded just a few years prior. His health also deteriorated, and he struggled with depression. On November 28, 1940, Jesse Livermore died by suicide, leaving behind a legacy of both unparalleled financial genius and profound personal tragedy. His story is a poignant reminder that immense wealth does not always equate to personal happiness or stability, you know.

Lessons From a Legend

Jesse Livermore's life, for all its dramatic turns, offers a treasure trove of lessons for anyone interested in markets, or really, just about life itself. One of the biggest takeaways is the absolute importance of discipline. Livermore had brilliant insights and developed powerful strategies, but his failures often came when he deviated from his own rules, driven by emotion or a desire for even greater gains. It's a powerful reminder that even the smartest people can be, you know, their own worst enemies in the market.

Another key lesson is the value of independent thought. Livermore rarely listened to tips or popular opinion. He did his own research, formed his own conclusions, and had the courage to act on them, even when everyone else was doing the opposite. This contrarian mindset, while risky, was often the source of his greatest successes. He understood that true opportunities often lie where others are afraid to look, or perhaps, just don't see, you know.

His story also highlights the unforgiving nature of leverage and speculation. While he made incredible fortunes, he also lost them, repeatedly. This shows that while high rewards are possible, they often come with equally high risks. It's a cautionary tale about managing risk and understanding that even the best traders can be wiped out if they don't respect the market's power. His life, in a way, serves as a timeless case study in the psychology of trading, emphasizing that mastery of oneself is just as important as mastery of the market. He was, truly, a complex figure whose lessons still resonate today.

Frequently Asked Questions About Jesse Livermore

How much money did Jesse Livermore make in the 1929 crash?

Jesse Livermore is widely reported to have made over $100 million during the 1929 stock market crash. This was, you know, an absolutely astonishing sum for that time, equivalent to several billion dollars in today's currency. He achieved this by taking massive short positions, betting that the market would fall, and he was, actually, spot on in his prediction.

What was Jesse Livermore's highest net worth?

His highest net worth was, arguably, right after the 1929 stock market crash, when his profits were estimated to be over $100 million. While precise figures are difficult to confirm given the historical context, this period represents the peak of his financial power. It was, truly, an incredible accumulation of wealth, making him one of the richest people in the world at that time, you know.

What was Jesse Livermore's trading strategy?

Jesse Livermore's strategy centered on observing price movements, identifying trends, and waiting for confirmation before making large trades. He practiced pyramiding, adding to winning positions, and crucially, cutting losses quickly. He also placed great importance on market psychology and, you know, maintaining discipline, avoiding emotional decisions. He was, in some respects, a master of timing and patience.

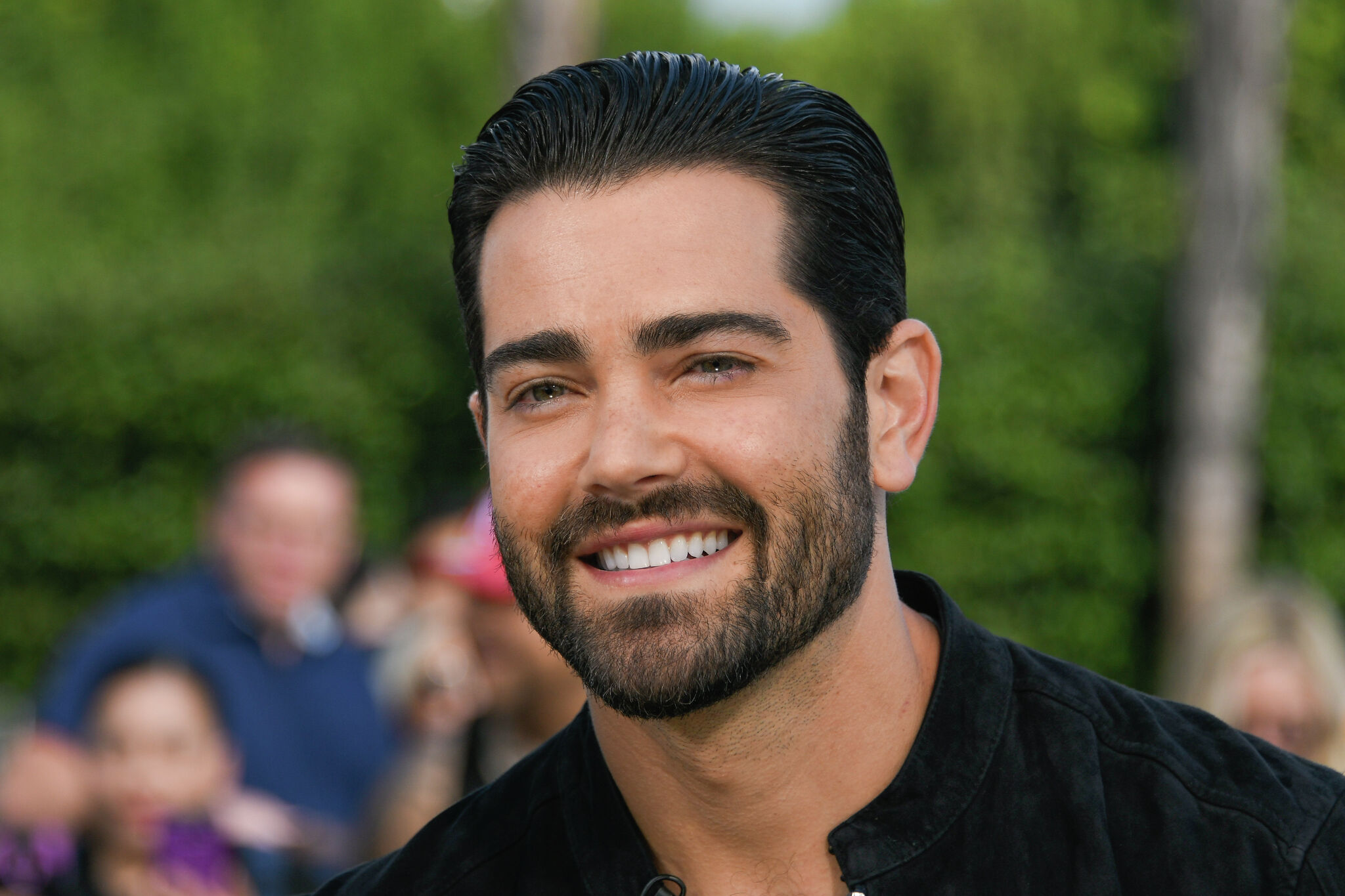

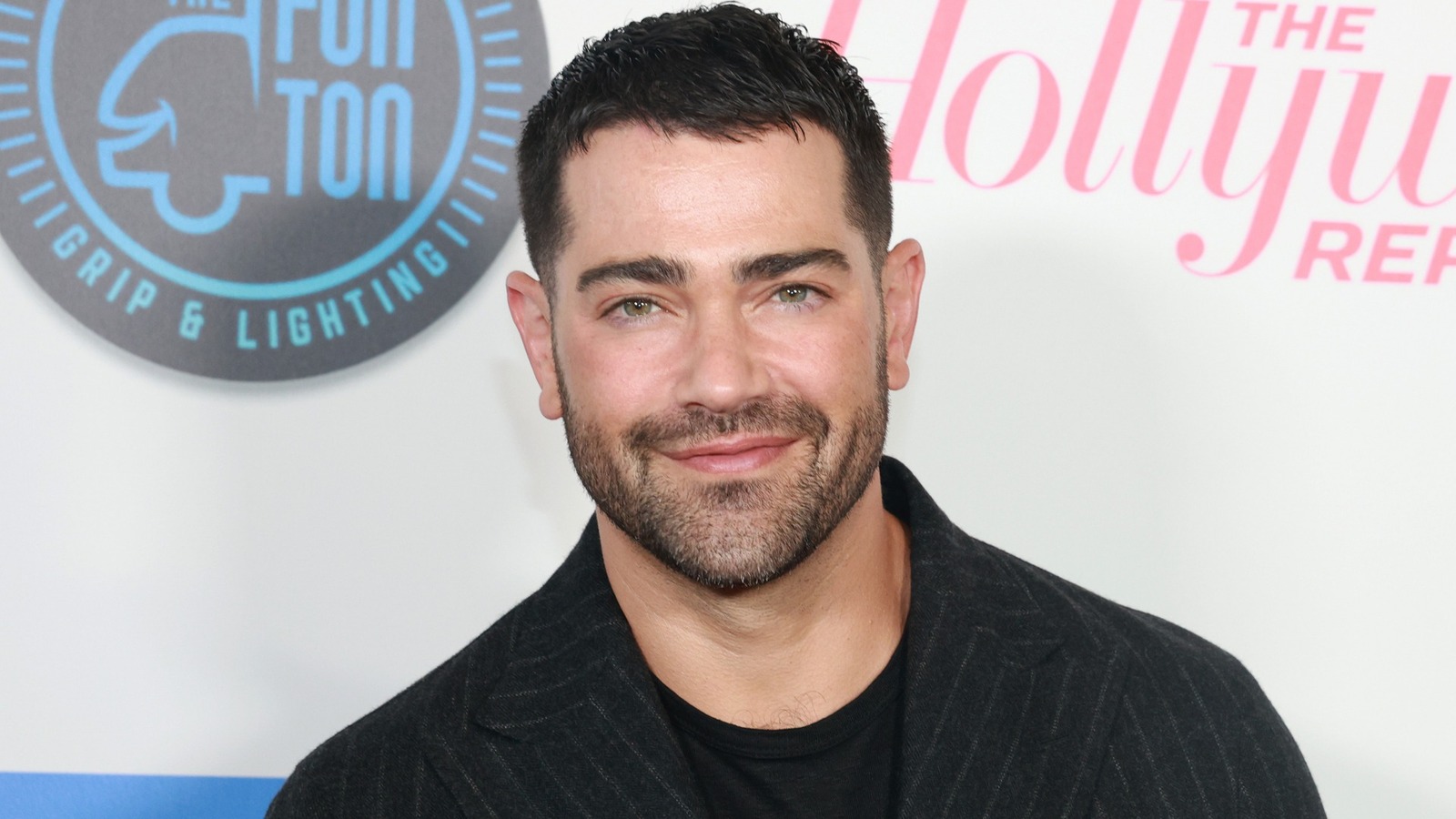

Jesse Metcalfe: The Rise Of A Star In 2024

Tributes paid to Jesse Baird and Luke Davies after bodies found

Unveiling The Love Life Of Jesse Metcalfe: Who Is His Kæreste?