Understanding AVG's Net Worth: What Shapes A Cybersecurity Giant's Value?

Ever wonder what makes a company truly valuable, especially one that helps keep your digital life safe? It's a question many people ask, particularly when they rely on a service daily. For a company like AVG, known for its antivirus and security products, its net worth isn't just a number; it tells a story about its influence, its market position, and how it continues to grow in a very busy digital world. It's a way, you know, of seeing the big picture.

Thinking about the net worth of a company like AVG is a bit like looking at the foundation of a very large building. You want to know if it's strong, if it can stand the test of time, and if it's built to support all the people who use it. This kind of financial insight gives us a clearer picture of the company's health and its ability to keep innovating for its users.

So, what exactly goes into figuring out the net worth of a major player in cybersecurity, like AVG? We'll explore the pieces that make up its financial picture, from its wide range of products to its place in a constantly changing industry. It's really quite interesting to see how it all fits together, isn't it?

Table of Contents

- What is AVG Technologies?

- Understanding Company Net Worth

- AVG in the Cybersecurity Market

- Factors Influencing AVG's Net Worth

- How to Gauge a Tech Company's Value

- Frequently Asked Questions

- The Future of AVG and Its Value

What is AVG Technologies?

AVG Technologies, for many people, is a name that brings to mind digital protection. It's a company that has been helping users keep their computers and devices safe from online threats for a very long time. They offer a whole suite of products designed to give you peace of mind while you're online.

Their offerings span quite a bit, from the foundational AVG Antivirus Free, which many people start with, to more comprehensive solutions like AVG Internet Security. They also provide tools for PC tune-up, making sure your computer runs smoothly, and even secure VPN services for added privacy. It's a pretty wide array of services, you know.

The company has built its reputation on providing reliable protection against viruses, malware, and other digital dangers. They aim to make it simple for anyone to get help with installation, technical support, and common questions. This focus on user assistance is a big part of their identity.

If you've ever needed help with AVG Antivirus, AVG Internet Security, or even AVG PC TuneUp installation, you'd likely turn to their customer support. They offer email, chat, and phone support, which is quite helpful for users. This commitment to helping customers is, in some respects, a core part of their service.

AVG also provides solutions for specific needs, like AVG Antivirus Free, AVG Internet Security, and even AVG Ultimate. They also cater to business users, offering support for license keys, billing, and even virus removal services. It's clear they try to cover a lot of ground.

Their history includes developing products for various platforms, including Android and Mac, showing their reach beyond just Windows PCs. This broad approach helps them serve a diverse group of users, which is quite important in today's tech landscape. You can learn more about AVG's products and services on our site.

Understanding Company Net Worth

When we talk about a company's net worth, we're essentially looking at its financial health. It's a way of figuring out how much the company would be worth if it sold off all its belongings and paid off all its debts. This calculation gives a snapshot of its financial standing at a particular moment.

For a company like AVG, or any business really, net worth is a key indicator for investors, analysts, and even curious customers. It helps people understand the scale of the business and its financial stability. It's a bit like checking your own personal finances, but on a much bigger scale.

Assets and Liabilities: The Core

At its simplest, net worth is calculated by taking a company's total assets and subtracting its total liabilities. Assets are everything the company owns that has value. This could be cash in the bank, buildings, equipment, or even intellectual property like software code and patents.

For AVG, assets would include things like their software licenses, the technology they've developed for virus scanning and malware removal, and any physical offices they might own. Their customer base itself, in a way, represents a valuable asset too, as it generates ongoing revenue.

Liabilities, on the other hand, are everything the company owes. This includes debts, loans, money owed to suppliers, and even future obligations like warranties or employee benefits. A company, just like a person, has financial commitments that need to be met.

So, when you take all the good stuff (assets) and subtract all the bad stuff (liabilities), what's left is the net worth. It's a fundamental accounting principle that provides a clear, albeit static, picture of financial strength.

Beyond the Numbers: Intangible Value

While the asset-minus-liability formula gives a baseline, a tech company's true value often goes much deeper. Intangible assets, things you can't physically touch, play a huge role. Think about brand recognition, customer loyalty, and proprietary technology.

For AVG, their brand name itself, which has been around for many years, carries significant weight. People trust AVG because of their long history in cybersecurity. This trust is an intangible asset that is incredibly valuable, even if you can't put a direct price tag on it easily.

The unique algorithms for virus detection, the user experience of their software, and the global network of users providing threat intelligence are all examples of these hard-to-quantify assets. These elements, frankly, contribute a lot to their overall market standing and perceived value.

A strong reputation for customer support, like the "Email, chat, & phone support available" that AVG offers, also adds to this intangible value. It builds confidence and encourages repeat business, which is very important for sustained growth.

AVG in the Cybersecurity Market

The cybersecurity market is a very busy and constantly changing place. New threats pop up all the time, and companies have to be quick to adapt and innovate. AVG has been a significant player in this space for a long time, evolving with the threats.

Their position in this market is a big part of their overall value. A company that holds a good share of the market, or is known for being a leader in certain areas, naturally has a higher perceived worth. It's all about how they stack up against the competition.

A History of Innovation

AVG's story began with a focus on antivirus protection, which was revolutionary at the time. Over the years, they expanded their offerings to include internet security, PC optimization, and more recently, mobile and VPN solutions. This constant innovation is, like, pretty crucial for staying relevant.

They've had to keep pace with the rapid changes in how people use computers and the internet. From desktop PCs to laptops, then to smartphones and tablets, AVG has tried to provide protection across all these devices. This adaptability shows a lot about their strategic thinking.

Their commitment to addressing new threats, such as those that require "virus removal" expertise, highlights their dedication to keeping users safe. This continuous development helps maintain their competitive edge, which is vital for any tech company.

Product Portfolio and User Base

The range of products AVG offers is quite extensive. From the free antivirus that gets many users started to premium products like AVG Internet Security, AVG PC TuneUp, and AVG Ultimate, they cater to different needs and budgets. This broad portfolio helps them reach a very wide audience.

A large and active user base is an incredibly valuable asset for a cybersecurity company. More users mean more data on new threats, which helps improve their protection services. It creates a kind of network effect, making their products more effective over time.

Think about the sheer number of people who rely on AVG Antivirus Free or AVG Internet Security for their daily online activities. This widespread adoption, honestly, speaks volumes about the trust people place in their brand.

Their focus on providing support for various products and issues, from "license keys" to "billing & purchases," reinforces the idea of a comprehensive service provider. This kind of customer care is often overlooked but contributes significantly to user retention.

Market Trends and Competition

The cybersecurity market is growing rapidly, driven by an increasing number of online threats and a greater reliance on digital services. This growth provides opportunities for companies like AVG, but it also brings intense competition. Many players are vying for market share.

Companies must constantly invest in research and development to stay ahead of new viruses and sophisticated cyberattacks. This requires significant resources, and a company's ability to do so reflects its financial strength. It's a bit of a race, you know.

In today's market, trends like cloud-based security, artificial intelligence in threat detection, and privacy tools like VPNs are very important. AVG's offerings, such as their "secure VPN," show they are adapting to these newer demands. This adaptation is essential for long-term relevance and value.

Factors Influencing AVG's Net Worth

Several key elements play a big part in determining a company's net worth, especially in the fast-paced tech world. These aren't just about the money coming in or going out; they involve strategy, market position, and even reputation.

Revenue Streams

For AVG, their revenue comes from several places. While many people know them for their free antivirus, they also generate significant income from premium subscriptions to products like AVG Internet Security and AVG Ultimate. These paid services offer more features and deeper protection.

Sales of their PC TuneUp software, which helps optimize computer performance, also contribute. Additionally, business support and enterprise solutions represent another important revenue stream. It's a pretty diverse set of income sources, which is good for stability.

The ability to convert free users into paying subscribers is a crucial part of their business model. This shows how effective their products are at building trust and demonstrating value. Basically, if people like the free version, they might pay for more.

Acquisitions and Mergers

A very significant event in AVG's history was its acquisition by Avast in 2016. This merger created a much larger cybersecurity entity, combining the strengths of both companies. When one company acquires another, the net worth of the acquiring company often changes significantly.

This kind of consolidation is common in the tech industry. It allows companies to expand their market reach, gain new technologies, and reduce competition. The combined entity, in this case, became one of the largest players in consumer cybersecurity.

So, when you talk about AVG's net worth today, you're often looking at it within the larger context of Avast's financial standing. It's a bit like two rivers joining to form a bigger one, you know, changing the overall flow.

Brand Reputation and Trust

In cybersecurity, trust is everything. Users are literally giving these companies access to their most sensitive digital spaces. A strong brand reputation, built over years of reliable service, is an invaluable asset. AVG has worked hard to build this trust.

Their official customer support, offering help with "installation, technical support, faqs, downloads, & more," plays a huge role in maintaining this trust. When users know they can get reliable assistance, it reinforces their confidence in the product and the company.

Any security breaches or privacy concerns can quickly erode this trust, impacting a company's value. That's why maintaining high security standards and transparent policies, like "About avg profile policies," is absolutely critical for a company like AVG.

Research and Development

Staying ahead of cybercriminals requires constant investment in research and development (R&D). AVG's ability to develop new features, improve existing ones, and adapt to emerging threats directly impacts its long-term viability and value.

This includes investing in advanced threat detection, cloud security, and even artificial intelligence to predict and neutralize new forms of malware. These investments are costly, but they are essential for keeping their products effective and competitive.

A company that consistently innovates and brings new solutions to market is generally seen as more valuable. It shows a commitment to future growth and relevance, which is very appealing to anyone looking at a company's worth.

How to Gauge a Tech Company's Value

For those curious about how to understand a tech company's worth, it's not just about the net worth number. You also look at things like market capitalization, which is the total value of a company's outstanding shares. For privately held companies, it's more about valuation metrics.

Analysts often consider revenue growth, profit margins, and the size of the company's user base. The potential for future growth in the market segment is also a big factor. Is the market expanding? Is the company positioned to capture more of it?

You might also look at how much a company spends on R&D compared to its revenue. A high R&D spend can indicate a commitment to innovation, which is usually a good sign for a tech company's future value. It's about seeing where the company is putting its resources.

For a deeper understanding of company valuation, you can explore resources like Investopedia's guide on net worth and company valuation. Understanding these concepts helps you interpret financial news more effectively.

Also, it's useful to compare a company's metrics to its competitors. How does AVG's performance or market share compare to other cybersecurity firms? This kind of comparative analysis gives you a better sense of its relative strength and value within the industry. You can link to this page about our company for more context.

Frequently Asked Questions

What is AVG Technologies?

AVG Technologies is a well-known cybersecurity company that provides a range of software products designed to protect digital devices. Their offerings include antivirus, internet security, PC tune-up tools, and VPN services. They aim to help users with things like "avg antivirus free installation" and "virus removal."

How does AVG make money?

AVG generates revenue primarily through sales of its premium software subscriptions, such as AVG Internet Security and AVG Ultimate. They also earn from their PC tune-up products and business support solutions. While they offer free versions, the goal is often to encourage users to upgrade to paid features.

Is AVG still a standalone company?

No, AVG Technologies is not a standalone company anymore. It was acquired by Avast in 2016. Today, AVG operates as a brand under the larger Avast umbrella, combining their resources and technologies to provide a broader range of cybersecurity solutions.

The Future of AVG and Its Value

The cybersecurity landscape is always shifting, and so too is the value of companies within it. For AVG, now part of Avast, its continued value will likely depend on its ability to adapt to new threats and user needs. Innovation remains absolutely key.

As of today, the demand for robust digital protection is higher than ever. Companies that can provide comprehensive, easy-to-use, and reliable security solutions will continue to thrive. AVG's long-standing commitment to customer support and product development, as seen in their diverse offerings and support channels, positions it well.

Keeping an eye on industry trends, new product releases, and how the company addresses emerging cyber challenges will give you a good sense of its ongoing worth. It's a continuous story of adaptation and growth in a very dynamic field.

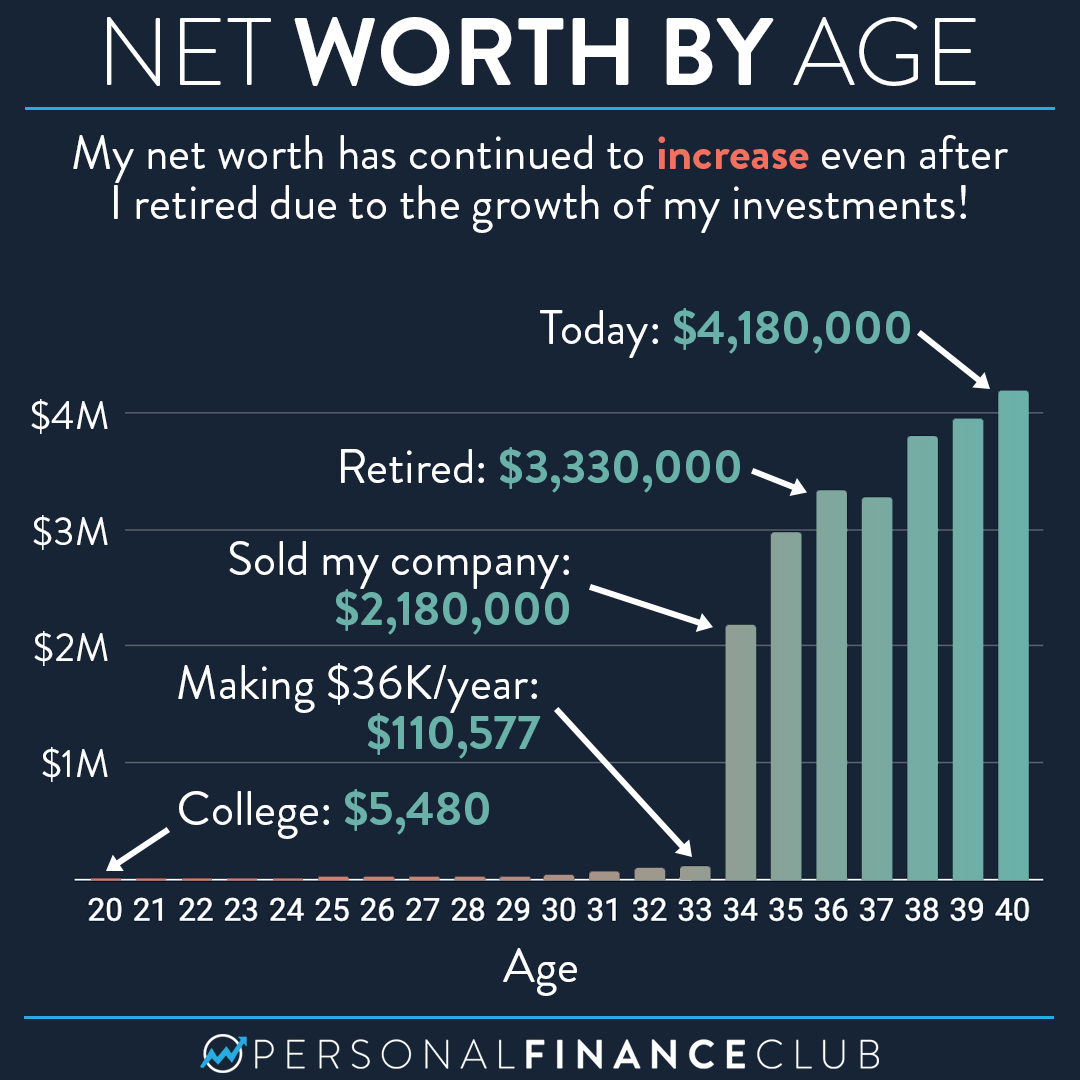

My $4 million net worth breakdown! – Personal Finance Club

NET WORTH OF A LIFE

Here’s how my net worth has changed in the last 20 years – Personal