How To Get A Clear Financial Picture: Why You Should Check Your Net Worth Today

Figuring out your financial standing is, you know, a bit like making sure all the boxes are ticked on a very important list. It’s about putting a sort of checkmark next to everything that adds up for you, and also noting what you owe. Just like you might see a checkmark symbol used to show something is valid or completed, doing this for your finances means getting a clear picture of where you stand right now. This simple act can truly change how you see your money situation.

So, many folks wonder what this "net worth" thing actually means. Essentially, it's a snapshot of your financial health at a specific moment. It tells you what you own, minus what you owe. This number can be a really powerful tool, giving you a baseline to work from as you make money plans for the future. It’s a very practical way to measure your financial progress over time.

You might be thinking, "Why bother?" Well, knowing this number helps you make smarter choices about saving, spending, and investing. It helps you see if you're moving closer to your money dreams, like buying a home, saving for retirement, or just feeling more secure. It’s, in a way, your financial scorecard, and checking it regularly can keep you on track, too it's almost a necessity for good money habits.

Table of Contents

- What Exactly is Net Worth?

- Why Figuring Out Your Net Worth Matters So Much

- How to Figure Out Your Net Worth: A Simple Guide

- What Can Make Your Net Worth Go Up or Down?

- Why You Should Look at Your Net Worth Often

- Common Questions About Net Worth

- Start Today: Your Path to a Better Financial Future

What Exactly is Net Worth?

At its heart, your net worth is a straightforward calculation. It’s the total value of everything you possess that has money value, minus all the money you owe to others. This number can be positive, meaning you own more than you owe, or it can be negative, which means you owe more than you own. Both are common, and both are just starting points, you know?

Think of it as a financial scale. On one side, you put all your valuable items, and on the other, all your debts. The difference tells you which way the scale tips. It's a pretty simple idea, but its meaning for your financial journey is quite big, actually.

This single number gives you a clear, overall picture of your financial health. It’s not about how much money you make each year, but rather how much wealth you have built up over time. It is that accumulation of value that truly counts for long-term security, too it's almost the most important number.

Why Figuring Out Your Net Worth Matters So Much

People often ask why they should even bother with this calculation. Well, it’s like having a map when you’re going on a trip. You need to know where you are now to figure out how to get where you want to go. Your net worth gives you that current location, you see.

For one thing, it helps you set real money goals. If you want to buy a house, save for your kids’ schooling, or retire comfortably, knowing your net worth helps you see how far you have to go. It’s a pretty good motivator, in a way, to keep working towards those big life moments.

It also helps you spot problems early. If your net worth is going down, that's a signal to look at your spending or debt. If it’s going up, you know your money plans are working! It's basically a feedback system for your finances, you know, a truly helpful one.

Moreover, it helps you make better decisions about big purchases or taking on new debt. Knowing your overall financial standing can prevent you from getting into too much trouble. It's a very practical tool for keeping your money life in good shape, that is for sure.

How to Figure Out Your Net Worth: A Simple Guide

Figuring out your net worth isn't hard at all. It just takes a little bit of time to gather some numbers. You don't need fancy software; a simple spreadsheet or even a piece of paper can do the trick. We're going to break it down into easy steps, okay?

Step One: List What You Own (Your Assets)

First, write down everything you own that has money value. Think about things you could turn into cash if you needed to. These are your assets. Be as complete as you can. This is the positive side of your financial picture, you know, the good stuff.

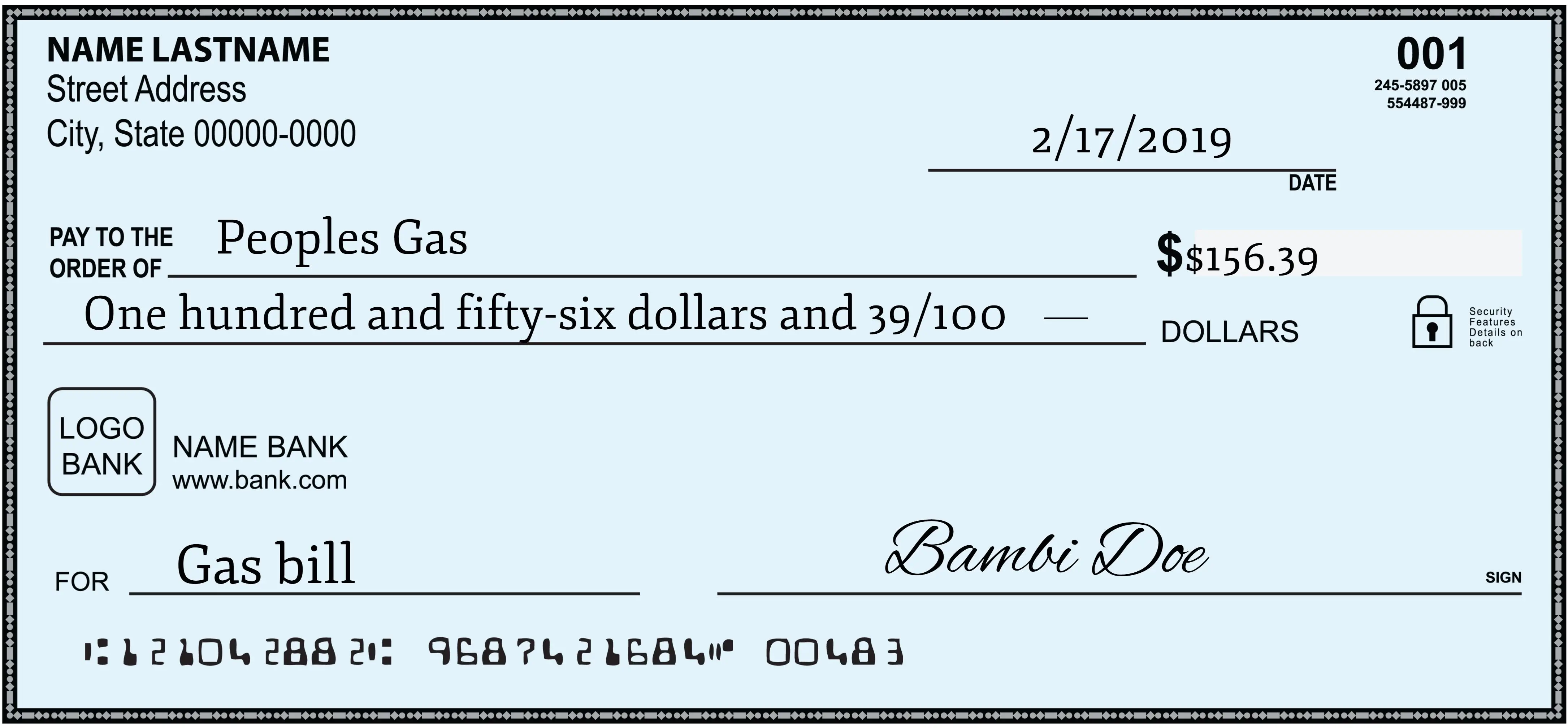

Cash and Bank Accounts: This includes the money you have in savings, checking accounts, and even, say, any actual paper checks you're holding onto that are waiting to be deposited. You know, those physical checks, which are sometimes called 'cheques' in other places, are a form of value too, provided they are current and can be cashed, usually within 180 days. Make sure to note the current date for these, as a check must be cashed within a certain time frame.

Investments: This covers things like stocks, bonds, mutual funds, retirement accounts (401k, IRA), and any other investment accounts you might have. List their current market value, basically what they're worth today.

Real Estate: If you own a home, rental properties, or land, include their estimated current market value. This can be a big part of many people's assets, you know, a really significant portion.

Vehicles: The current market value of your cars, motorcycles, boats, or other vehicles. Don't list what you paid for them, but what they would sell for now, more or less.

Valuable Personal Items: This might include things like expensive jewelry, art, collectibles, or other items of significant value. Only include things that could actually be sold for a good amount of money, not just sentimental items, obviously.

Add up the total value of all these items. This sum is your total assets. It's basically everything you possess that has a price tag on it, you know, if you had to sell it.

Step Two: List What You Owe (Your Liabilities)

Next, write down all your debts. These are the things you owe money on. This is the negative side of your financial picture, the money that needs to go out. It's pretty important to be thorough here, you know, to get an accurate count.

Mortgages: The outstanding balance on your home loan or any other property loans. This is often the biggest debt for many people, you know, a very large amount.

Car Loans: The remaining balance on any vehicle loans you have. This is usually a pretty straightforward number to find, too it's almost always on your monthly statement.

Credit Card Debt: The total amount you owe across all your credit cards. This can add up quickly, so be sure to list every card, basically.

Student Loans: The total outstanding balance on your student loans. These can be long-term debts, so getting an accurate number is key, you know, for your overall picture.

Personal Loans: Any other loans you've taken out, like from a bank or a friend. Include the current balance for each, that is important.

Other Debts: This could include medical bills, tax debts, or any other money you owe to someone else. Don't forget these smaller ones, they can actually add up.

Add up the total amount of all these debts. This sum is your total liabilities. It's basically all the money you're on the hook for, you know, all the payments you still need to make.

Step Three: Do the Simple Math

Now for the easy part! Once you have your total assets and your total liabilities, you just do one simple subtraction. Your net worth is your total assets minus your total liabilities. That's it! It’s really quite simple, you know, just a quick calculation.

Net Worth = Total Assets - Total Liabilities

For example, if you own things worth $300,000 and you owe $100,000, your net worth would be $200,000. If you own things worth $50,000 and you owe $70,000, your net worth would be -$20,000. Both are just numbers, and both can change, obviously.

What Can Make Your Net Worth Go Up or Down?

Your net worth isn't a fixed number; it changes all the time. Many things can make it go up or down. Understanding these influences can help you make choices that lead to growth. It's like a living, breathing number, you know, always shifting.

When your assets increase in value, your net worth goes up. For instance, if your home's value rises, or your investments grow, that's a positive change. Also, paying down your debts means your liabilities shrink, which also increases your net worth. Saving more money and putting it into accounts or investments is another sure way to see that number climb, that is definitely true.

On the flip side, if your assets lose value, or you take on more debt, your net worth will go down. For example, if the stock market drops, or you take out a big new loan, that will affect your number. Spending more than you earn, or not saving enough, can also cause your net worth to shrink. It’s a pretty direct relationship, you know, between your actions and the number.

Why You Should Look at Your Net Worth Often

Just like you might check the oil in your car regularly, it's a good idea to look at your net worth often. Most financial experts suggest doing it at least once a year, but some people like to do it every few months. It really helps you stay on top of things, basically.

Regular reviews help you see trends. Are you consistently building wealth? Or are there times when your net worth dips? Seeing these patterns can help you adjust your money habits and plans. It's a way to keep your financial pulse, you know, to make sure everything is healthy.

It also keeps you accountable to your own money goals. If you see your net worth growing, it's a great feeling and a motivator to keep going. If it's not moving as you'd like, it's a gentle nudge to make some changes. This consistent review is, in a way, a very important part of managing your money well. You can learn more about personal financial planning on our site, which really helps with this.

Common Questions About Net Worth

What is a good net worth for my age?

There isn't one perfect number for everyone, as a matter of fact. What's considered "good" often depends on your income, where you live, and your life goals. However, many financial guides offer general benchmarks based on age and income levels. It’s more about seeing consistent growth over time than hitting a specific number by a certain age, you know, that gradual progress is key.

How often should I check my net worth?

Most people find that checking their net worth once a year is plenty. It gives you enough time to see real changes and make adjustments. Some folks who are really focused on money goals might check every quarter. The main thing is to do it consistently, you know, to make it a habit.

Does my house count towards net worth?

Yes, absolutely! Your home is typically one of your biggest assets. You include its current market value in your assets list. However, you also need to include any outstanding mortgage balance as a liability. The difference between the home's value and what you owe on it (your home equity) is what contributes to your net worth. It’s a very important part of the calculation for many people, basically.

Start Today: Your Path to a Better Financial Future

Taking the time to check your net worth is a really empowering step. It gives you clarity and control over your money story. It’s not about judging yourself, but about getting a clear picture so you can make informed choices. This simple act can set you on a path to greater financial peace, you know, a very good feeling.

Don't put it off. Gather your numbers, do the simple math, and see where you stand. You might be surprised, and you’ll definitely be better prepared for what’s ahead. For more resources on managing your money, you can look at sites like the Consumer Financial Protection Bureau, which has a lot of helpful information. Also, consider exploring our budgeting tools to help you track your progress.

How to write a check | finder.com

Checkmark Powerpoint - ClipArt Best

Free Picture Of Check Mark, Download Free Picture Of Check Mark png