What Is Bill Chisholm's Net Worth? Unpacking The Financial Picture

It's a question many folks wonder about when they hear a name like Bill Chisholm: what exactly is his financial standing? Figuring out someone's net worth can be a bit like piecing together a puzzle, you know, especially when the details are not widely public. People are often curious about the financial journeys of individuals, whether they're public figures or just someone whose name pops up in conversation.

For a lot of us, understanding how wealth is built and measured is pretty interesting, so we often look to examples. When we talk about someone's net worth, we're essentially looking at everything they own—like their assets—minus everything they owe, which are their liabilities. It’s a pretty straightforward idea, but the numbers themselves can be quite complex, and that's often where the real guessing game begins.

Now, it's worth noting right away that the information provided in "My text" primarily focuses on various billing and payment experiences, such as recurring charges for Microsoft services, issues with credit card information, and inquiries about Skype bills. Interestingly enough, this text doesn't actually contain any specific details or figures about a person named Bill Chisholm's net worth. So, while we can't pull direct numbers from that source, we can certainly explore how one might go about understanding and estimating net worth in general, using Bill Chisholm as a kind of example for our discussion.

Table of Contents

- Understanding Net Worth: The Basics

- Who Is Bill Chisholm? A Look at a Hypothetical Profile

- How Net Worth Is Calculated: Assets Minus Liabilities

- Factors Influencing Net Worth Over Time

- Challenges in Estimating Net Worth for Individuals

- FAQ About Net Worth

- Staying Informed About Financial Matters

Understanding Net Worth: The Basics

When someone asks, "what is Bill Chisholm's net worth?", they're essentially asking for a snapshot of his financial health at a particular moment. It's a simple equation, really: what you own minus what you owe. This figure can change quite a bit over time, you know, depending on investments, income, spending, and even market conditions. It's a pretty useful metric for individuals to track their own financial progress, and it gives a general idea of someone's economic standing.

For public figures or well-known business people, their net worth often becomes a topic of public discussion, but for most private individuals, this kind of information is, well, private. It's not something you'd usually find just floating around, so to speak. So, when we talk about Bill Chisholm, we're really looking at a theoretical exercise in how one might assess such a figure.

A lot of the time, people confuse net worth with income. Income is what you earn, like a salary or business profits, over a period of time. Net worth, on the other hand, is a cumulative measure of all your wealth. You could have a high income but also high debts, which would lower your net worth. Or, you might have a modest income but have built up substantial assets over many years, resulting in a healthy net worth. It's a bit of a different picture, that.

Who Is Bill Chisholm? A Look at a Hypothetical Profile

Since our provided text doesn't give us specific details about a real Bill Chisholm's background or financial standing, we'll imagine a hypothetical Bill Chisholm for the purpose of this article. This allows us to explore the various aspects that contribute to someone's net worth in a more concrete way, even if the individual himself is a stand-in. Think of it as a case study, you know, to help illustrate the points.

Our hypothetical Bill Chisholm could be, for instance, a successful entrepreneur who started a tech company in the early 2000s. Perhaps he later sold his stake, or maybe he's still actively involved in the business, which continues to grow. He might also be a seasoned professional in a high-earning field, like finance or law, who has diligently saved and invested over several decades. Or, he could be someone who inherited wealth and has been managing it wisely. The possibilities are pretty wide open, actually.

The type of career path or financial history Bill Chisholm has would, of course, significantly influence his potential net worth. Someone who founded a successful startup would likely have a different asset profile than, say, a long-term corporate executive. It's all about the sources of wealth and how they've been managed, really.

Personal Details and Bio Data: Bill Chisholm (Hypothetical)

For our illustrative purposes, here's a made-up profile for Bill Chisholm. Remember, this is purely for demonstration, as actual personal financial details are typically private.

| Detail | Description (Hypothetical) |

|---|---|

| Full Name | William "Bill" Robert Chisholm |

| Age | 58 years old (as of late 2024) |

| Occupation | Retired Tech Entrepreneur / Angel Investor |

| Primary Source of Wealth | Sale of a software company (founded 1998, sold 2015), subsequent investments |

| Education | Bachelor's Degree in Computer Science, State University |

| Family Status | Married, two adult children |

| Location | Suburban area, likely near a major tech hub |

| Known For | Early adopter in cloud computing, philanthropic interests in education |

How Net Worth Is Calculated: Assets Minus Liabilities

To truly get a handle on "what is Bill Chisholm's net worth," or anyone's for that matter, you need to add up all the things they own (assets) and then subtract all the things they owe (liabilities). The resulting number is their net worth. It's a pretty straightforward formula, yet the details can get a bit intricate. Assets can be liquid, like cash, or illiquid, like real estate, and assigning a precise value can sometimes be a bit of an art.

For instance, if Bill Chisholm owns a house, its current market value would be an asset. But if he still has a mortgage on it, that mortgage balance would be a liability. The difference contributes to his net worth. This applies to all sorts of possessions, from cars to investment portfolios. So, it's not just about what you have, but also what claims others have on those things.

It's also important to value assets realistically. A vintage car might be worth a lot to a collector, but its true market value is what someone would actually pay for it today. Similarly, a business owner might value their company highly, but its value for net worth purposes is often based on its current market valuation or a professional appraisal. This can be a tricky part, actually, getting those numbers just right.

Common Assets to Consider

When we're thinking about Bill Chisholm's assets, or anyone's, there are several categories that usually come to mind. These are the things that add value to his financial picture. For example, cash and cash equivalents are pretty simple to count, like money in checking or savings accounts, or even short-term certificates of deposit. These are readily available funds, so they're quite liquid, you know.

Then there are investments. This is a pretty big category and can include stocks, bonds, mutual funds, exchange-traded funds (ETFs), and even alternative investments like private equity or hedge funds. If our hypothetical Bill Chisholm sold a tech company, he likely has a substantial portion of his wealth in various investment portfolios, perhaps managed by financial advisors. These values can fluctuate daily, so getting a precise, up-to-the-minute figure is, well, pretty hard.

Real estate is another significant asset. This includes primary residences, vacation homes, rental properties, or even commercial properties. The value here is typically the current market value. For Bill, this could mean a nice family home, maybe an investment property or two. Businesses or ownership stakes in companies also count as assets. If Bill still holds shares in a company he founded or has invested in other startups, those ownership interests are valuable. Retirement accounts, like 401(k)s, IRAs, or pensions, are also a big part of someone's assets, as they represent savings for the future. Personal property, such as vehicles, art collections, jewelry, or other valuable possessions, also adds to the asset side, though these are sometimes harder to value accurately and are usually a smaller percentage of overall net worth for wealthy individuals.

Typical Liabilities to Account For

On the flip side of assets, we have liabilities, which are the debts or financial obligations someone owes. These reduce the overall net worth. The most common liability for many people, including potentially Bill Chisholm, is a mortgage. This is the outstanding balance on loans taken out to buy real estate. Even if he owns a multi-million dollar home, if there's a significant mortgage, that debt subtracts from the asset's contribution to net worth.

Other loans are also liabilities. This can include car loans, student loans (though less likely for a successful entrepreneur of his age, perhaps), or personal loans. Credit card debt is another common liability, representing money owed on credit lines. While the "My text" you provided mentions various charges to bill features and recurring bills, it really highlights how easily these kinds of financial obligations can accumulate, even if they are smaller amounts like $11.95 or $14.95 for subscriptions. These kinds of smaller, recurring bills, if left unpaid, could eventually become liabilities, but generally, for someone with substantial net worth, these are usually paid off regularly.

Taxes owed, such as income taxes, property taxes, or capital gains taxes on investments, are also liabilities until they are paid. Any outstanding business debts, if Bill still has active business ventures with loans or lines of credit, would also be counted. So, when you add up all these debts and subtract them from the total assets, you get the net worth figure. It's a simple idea, but getting all the numbers can be quite a task, you know, especially for someone who has a complex financial life.

Factors Influencing Net Worth Over Time

A person's net worth is not a static number; it's a bit like a living thing, changing and evolving over time. Several key factors play a big role in how it grows or shrinks. For someone like our hypothetical Bill Chisholm, his career trajectory would be a huge influence. Starting a successful tech company and selling it, for example, would provide a significant boost to his assets. Consistent high income from a professional career, coupled with smart financial decisions, also contributes immensely.

Investment performance is another major factor. If Bill's investments in stocks, real estate, or other ventures perform well, his assets will grow, increasing his net worth. Conversely, a downturn in the market or poor investment choices could reduce it. Inflation, too, plays a part; while it might seem subtle, it affects the purchasing power of money and the real value of assets over the long run. Taxes are also a constant consideration; capital gains taxes on asset sales or high income taxes can certainly impact the rate at which wealth accumulates. It's a pretty complex interplay of forces, that.

Spending habits, believe it or not, also matter. Even for someone wealthy, excessive spending without a corresponding increase in assets or income can erode net worth over time. On the other hand, disciplined saving and reinvestment can lead to substantial growth. Economic conditions, like recessions or booms, can also have a broad impact on asset values, affecting everyone, including those with significant wealth. It's a dynamic picture, to be honest.

Challenges in Estimating Net Worth for Individuals

Estimating someone's net worth, especially if they're not a public figure like a CEO of a publicly traded company or a famous celebrity, is incredibly difficult. For one thing, most of the information is private. People generally don't share their bank account balances, investment portfolios, or detailed debt statements with the public. So, any figures you see for a private individual are usually just educated guesses or estimates, you know.

Valuing private assets is another big challenge. How do you accurately value a privately held business, for example? Or a unique art collection? These aren't always traded on public markets, so their true worth can be subjective and require professional appraisals. The value of real estate can also fluctuate, and while public records might show purchase prices, the current market value can be different. Plus, there are liabilities, like mortgages or other loans, which are almost always private. Without knowing these, any net worth calculation is incomplete, to be honest.

Furthermore, philanthropic activities or large gifts can significantly impact net worth, and these aren't always publicly disclosed. People might also hold assets in trusts or other complex financial structures, making it even harder to trace their true wealth. So, when you see an estimate for "what is Bill Chisholm's net worth" (if one were to appear), it's probably based on publicly available clues, like property records or business affiliations, but it's rarely a precise figure. It's a bit like trying to see the whole picture through a tiny keyhole, that.

FAQ About Net Worth

Here are some common questions people often ask about net worth, which can help shed more light on the topic, even when discussing a hypothetical figure like Bill Chisholm.

How do financial experts estimate the net worth of wealthy individuals?

Financial experts and publications often estimate the net worth of wealthy individuals by looking at publicly available information. This includes things like stock holdings in publicly traded companies, property records, known business ventures, and reported sales of companies or major assets. They might also consider known salaries, investments in other businesses, and any publicly disclosed philanthropic donations. It's a pretty involved process, actually, often involving a lot of research and making educated assumptions based on available data. They also typically account for market trends and industry averages to refine their estimates.

Is net worth the same as liquid assets?

No, net worth is definitely not the same as liquid assets. Liquid assets are just one part of a person's total assets, and they refer specifically to things that can be quickly converted into cash without a significant loss in value. Think cash in a bank account, easily tradable stocks, or money market accounts. Net worth, on the other hand, includes all assets—both liquid and illiquid—minus all liabilities. So, while liquid assets contribute to net worth, they are only a portion of it. A person could have a very high net worth but relatively few liquid assets if most of their wealth is tied up in real estate, private businesses, or other investments that aren't easily sold.

Can someone's net worth be negative?

Yes, absolutely, someone's net worth can be negative. This happens when a person's total liabilities (what they owe) are greater than their total assets (what they own). For example, if someone has significant student loan debt, a large mortgage, and credit card debt, but their assets (like a car or a small savings account) don't add up to as much, their net worth would be below zero. It's a pretty common situation for younger people just starting out, or for anyone who has taken on substantial debt without accumulating enough assets to offset it. It's a clear indicator that financial obligations outweigh financial possessions.

Staying Informed About Financial Matters

Understanding concepts like net worth is a pretty good step towards better financial literacy. While we can't definitively answer "what is Bill Chisholm's net worth" without private financial data, exploring how net worth is calculated and what influences it helps us all get a better grip on personal finance. It's really about knowing your own financial picture, you know, and making choices that help you build a more secure future.

For more general information on managing your finances and understanding different types of financial obligations, you might find it helpful to look at resources that discuss things like how to calculate your own net worth. This can give you a clearer idea of your own financial standing. Learning more about personal finance strategies on our site, and checking out this page about managing recurring bills, could also be pretty useful for keeping your financial house in order.

Bill Simmons Net Worth 2025 » NetWorth20

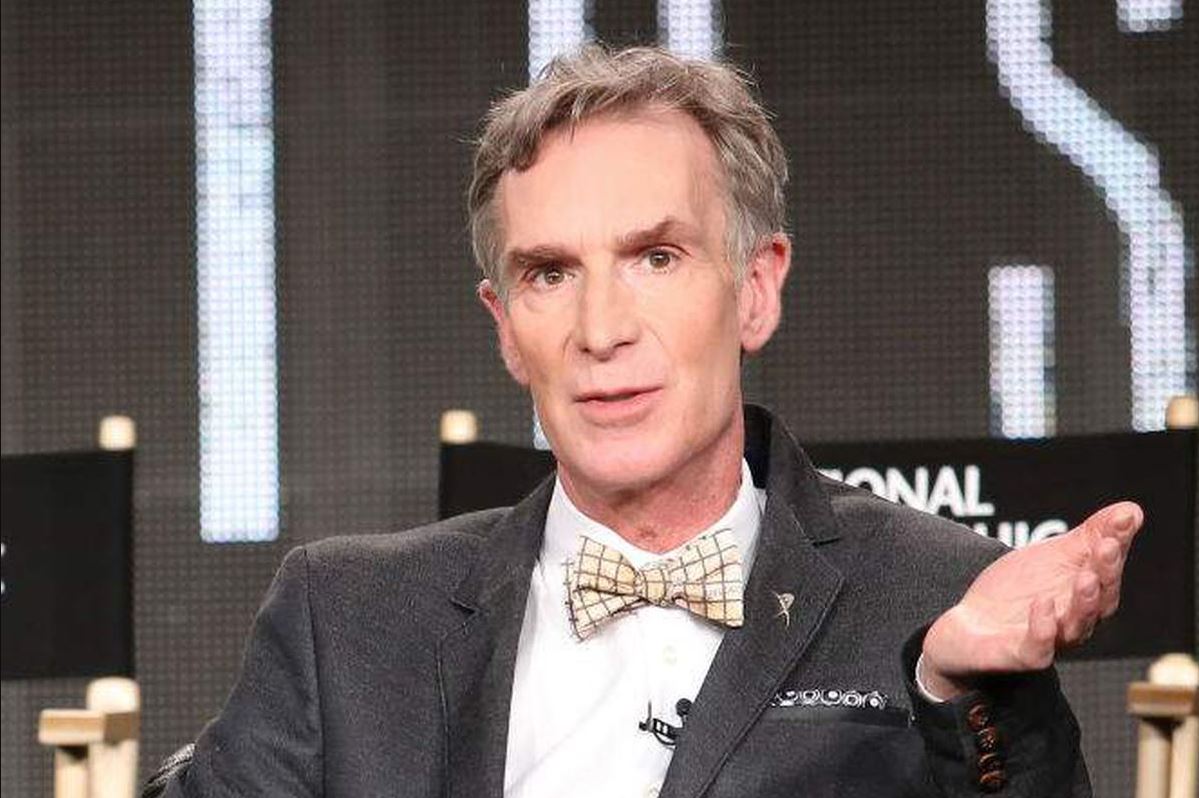

Bill Nye Net Worth in 2024 (Updated) | AQwebs.com

Bill Goldberg's Net Worth (Updated 2024) | Wealthy Gorilla